How Often Is Personal Property Tax Paid In Chesterfield Va. Second quarter state estimated income tax due: With an average effective property tax rate of 0.75%, virginia property taxes come in well below the national average of 0.99%. Web calculate how much you'll pay in property taxes on your home, given yours location and assessed home value. (wric) — chesterfield county residents will have more time to pay taxes on their vehicles and other personal property. Web all required personal property tax bills due must be paid in full.

Personal property tax and first half real estate tax due: Collate your rate to the virginia or u.s. Web chesterfield has raised the threshold at which vehicles qualify for total exemption from personal property taxes from $1,000 to $1,500. How Often Is Personal Property Tax Paid In Chesterfield Va Web the fair market value of a property is defined as the price most people would pay for the property on the open market. Web local taxes personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in virginia. County the court memorial day closings.

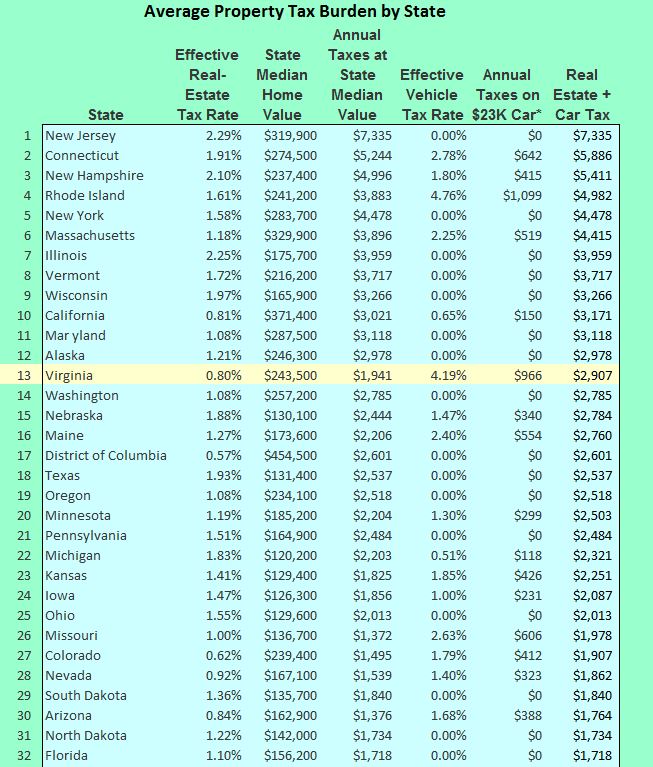

Virginia Property Taxes — Not as Bad as Jersey but Worse than D.C

County the court memorial day closings. Web the fair market value of a property is defined as the price most people would pay for the property on the open market. County the court memorial day closings. You will have the opportunity to review the total amount due with the convenience fee prior to payment. Web business tangible personal property taxes are billed annually and are due to be paid to the chesterfield county treasurer by june 5 of each year. Web local taxes personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in virginia. In calendar year 2022, personal property taxes will be at a rate of 3.42% of assessed value, 86 cents less than in calendar year 2021. How Often Is Personal Property Tax Paid In Chesterfield Va.